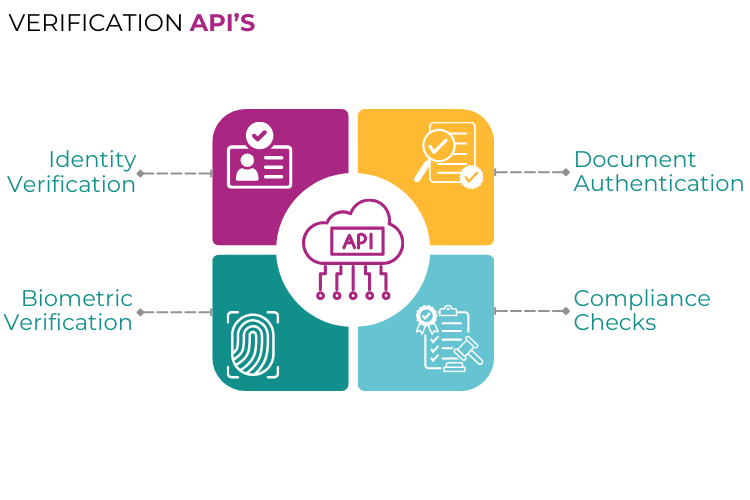

Verification API’s

KYC (Know Your Customer) API refers to an application programming interface that facilitates the integration of KYC processes and functionality into software applications, websites, and systems. KYC is a regulatory requirement imposed on businesses, particularly in the financial services industry, to verify the identity of their customers and assess their risk levels to prevent money laundering, fraud, and other illicit activities. Here's a closer look at the features and benefits of KYC API:

Identity Verification:

KYC API enables businesses to verify the identity of their customers by securely collecting and validating personal information such as name, address, date of birth, and government-issued identification documents (e.g., passport, driver's license, national ID card). This helps ensure that customers are who they claim to be, reducing the risk of identity theft and fraud.

Document Authentication:

KYC API automates the process of document authentication by verifying the authenticity of identity documents submitted by customers. This includes checking for security features such as holograms, watermarks, and security threads, as well as comparing the information on the document with external databases and watchlists to detect any discrepancies or inconsistencies.

Biometric Verification:

Some KYC APIs offer biometric verification capabilities, allowing businesses to verify customers' identities using biometric data such as fingerprints, facial recognition, or voice recognition. Biometric verification provides an additional layer of security and helps prevent impersonation and identity fraud.

Compliance Checks:

KYC API facilitates compliance checks against regulatory requirements and sanctions lists to ensure that customers are not involved in illegal activities or prohibited transactions. This includes screening customers against global watchlists, politically exposed persons (PEPs) lists, and sanctions lists maintained by government agencies and international organizations.

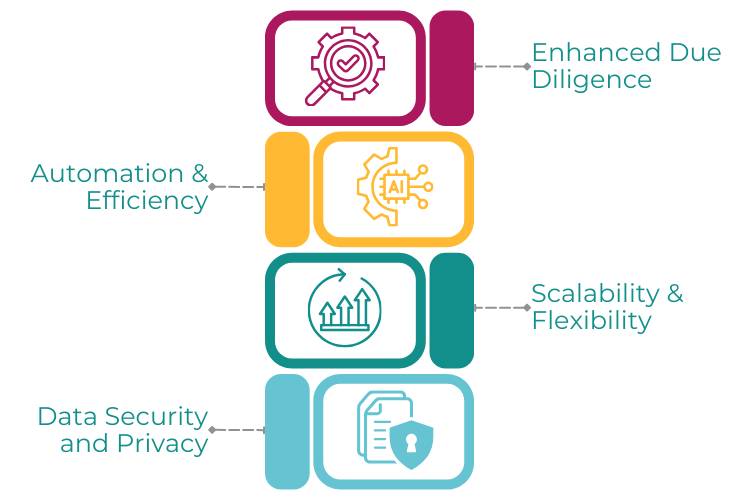

Enhanced Due Diligence:

For customers deemed to pose a higher risk based on factors such as their country of residence, occupation, or transaction history, KYC API enables businesses to conduct enhanced due diligence to gather additional information and assess their risk levels more thoroughly. This helps businesses mitigate the risk of money laundering and terrorist financing.

Automation and Efficiency:

By automating KYC processes through API integration, businesses can streamline customer onboarding, reduce manual errors, and improve operational efficiency. KYC API eliminates the need for paper-based documentation and manual verification processes, enabling businesses to onboard customers faster and more cost-effectively.

Scalability and Flexibility:

KYC API is highly scalable and flexible, capable of handling large volumes of customer data and transactions. It can be integrated into existing software applications, CRM systems, and customer-facing interfaces, allowing businesses to adapt and scale their KYC processes to meet changing regulatory requirements and business needs.

Data Security and Privacy:

KYC API prioritizes data security and privacy by employing encryption, secure data transmission protocols, and strict access controls to protect sensitive customer information from unauthorized access, tampering, or theft. Businesses can trust that customer data is handled securely and in compliance with applicable data protection regulations.

In summary, KYC API is a valuable tool for businesses seeking to comply with regulatory requirements, mitigate financial crime risks, and enhance customer trust and security. By integrating KYC functionality into their systems and processes, businesses can onboard customers more efficiently, mitigate risks effectively, and build stronger relationships with customers while ensuring compliance with regulatory standards.